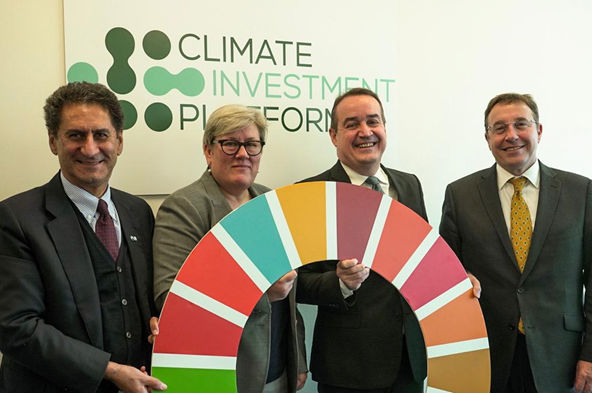

In response to country needs to mobilize low-carbon, climate-resilient investments, a new global public good announced today will aim to increase the flow of capital in developing countries to meet climate ambitions. The Climate Investment Platform (CIP) is an inclusive partnership welcoming all stakeholders from governments and international organizations to the private sector to scale-up climate action and translate ambitious national climate targets into concrete investments on the ground.

With energy accounting for two thirds of total greenhouse gas emissions, the platform’s first service line is dedicated to the global transition to clean energy. Other service lines, such as adaptation, land use, cities and infrastructure will be launched in the first quarter of 2020. By decluttering and streamlining support to developing countries, the platform aims to accelerate action and advance climate investment in developing countries. Progress will be presented at UNFCCC COP 25 in December 2019.

The service offered by the CIP covers four key building blocks along the climate finance value-chain: supporting governments to specify ambitious energy targets and scale up their nationally determined contributions (NDCs), establishing well-designed, implemented and enforced clean energy policies and regulations, financial de-risking of energy projects, and a market-place to connect clean energy investors and project sponsors.

“The Climate Investment Platform is a crucial initiative that will simplify access to climate finance. It will catalyze investment for mitigation and adaptation in developing countries, supporting those most in need of climate action,” said Green Climate Fund Executive Director Yannick Glemarec.

“Renewable energy is the most effective and ready solution to rising carbon emissions. Together with energy efficiency, they can deliver 90 per cent of the emission reductions needed under the Paris Agreement, but investment and deployment must increase significantly,” said IRENA Director-General Francesco La Camera. “This partnership combines the strengths of the respective organisations to deliver tailored, proactive policy and investment support to set the energy transformation on a climate-safe path.”

“Finance is the lynchpin to achieving Sustainable Development Goal 7 and countries’ Paris Agreement commitments. However, the evidence is clear that global investment is dramatically off track to meet universal access to energy by 2030,” said Rachel Kyte, CEO and Special Representative of the UN Secretary-General for Sustainable Energy for All (SEforALL). “The Climate Investment Platform will help bridge the gap between supply and demand to accelerate capital and scale up climate resilient investments, allowing countries to raise their climate targets and develop policy environments that allow investment to flow.”

“A powerful partnership of key institutions in the energy sector, the Climate Investment Platform will help to accelerate system-wide change and deliver co-benefits across the Sustainable Development Goals (SDGs) – from employment and economic growth to reduced inequalities and improved health.” said UNDP Administrator Achim Steiner.